| • | Can I report wages in more than 1 state? |

Yes. Magtax will handle 2 states.

| • | What is the process of reporting multiple states? |

Let's break this down into "Multiple State Options", "Importing Multiple States", "Adjusting Multiple States", "Printing Multiple States", and "Filing Multiple States"

Some definitions:

Multiple State Options

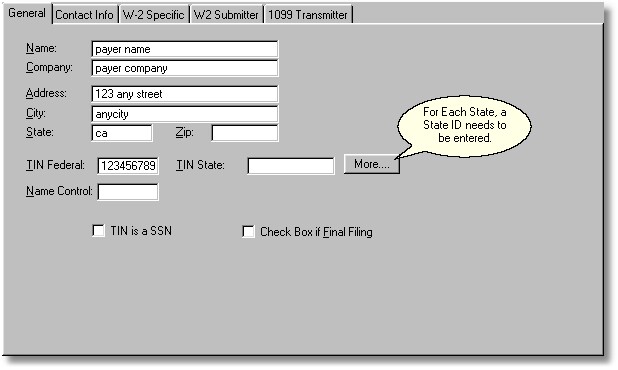

State ID's need to be entered using the 'More' button in Company maintenance. The Company's State and TIN State field become the defaults for all employees.

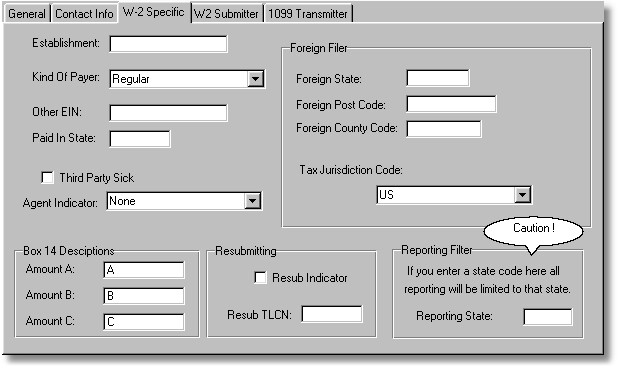

Next, set the default Paid In state. Also, make sure you DO NOT enter a value for the Reporting State below. This is a filter and will limit all reports to that State.

| • | Importing Multiple States |

Field Options Include fields that indicate State1 or State2. Just make sure you assign the correctly related withholding, etc.

QuickBooks does not have multiple wage amounts listed - this can be fixed with the bulk change function to assign Federal Wages to a state.

| • | Adjusting Multiple States |

The Bulk Change function allows you to assign Federal Wages to State Wage fields.

| • | Printing Multiple States |

The W2 form handles 2 states on each form. If more than 2 states are used, a second W2 is printed.

| • | Filing Multiple States |

Multiple state records are generated automatically. You can provide a copy of the W2REPORT file to your state if they do not participate in the SSA's program.